Calculate medicare tax 2023

As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. This calculator is for 2022 Tax Returns due in 2023.

Easiest 2021 Fica Tax Calculator

People who owe this.

. Medicare Advantage plans as low as 0month. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

The income on your 2021 tax return to be filed in 2022. Rising inflation coupled with a 145 Medicare Part B premium increase from 2021 to 2022 raises. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Once you have a good idea of your taxes or if you just want to get your taxes done with start with a free Taxpert account and file federal and. This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status. The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000 for singles and 250000 for couples.

Prepare and e-File your. Calculate Your 2023 Tax Refund. You pay all costs.

The standard Part B premium for 2022 is 17010. 2021 Tax Calculator Exit. The Tax Calculator uses tax information from the tax year 2022 2023 to show.

Medicare tax calculator 2023 Jumat 09 September 2022 This calculator includes the 38 Medicare contribution tax on the lesser of a net investment income or b modified. 4 hours agoSocial Security recipients can calculate the increase by taking their gross. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income.

How Do You Calculate Medicare Tax. Based on the Information you entered on this 2021 Tax Calculator you. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Employers and employees split the tax. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Remember the income on your 2020 tax return AGI plus muni interest determines the IRMAA you pay in 2022.

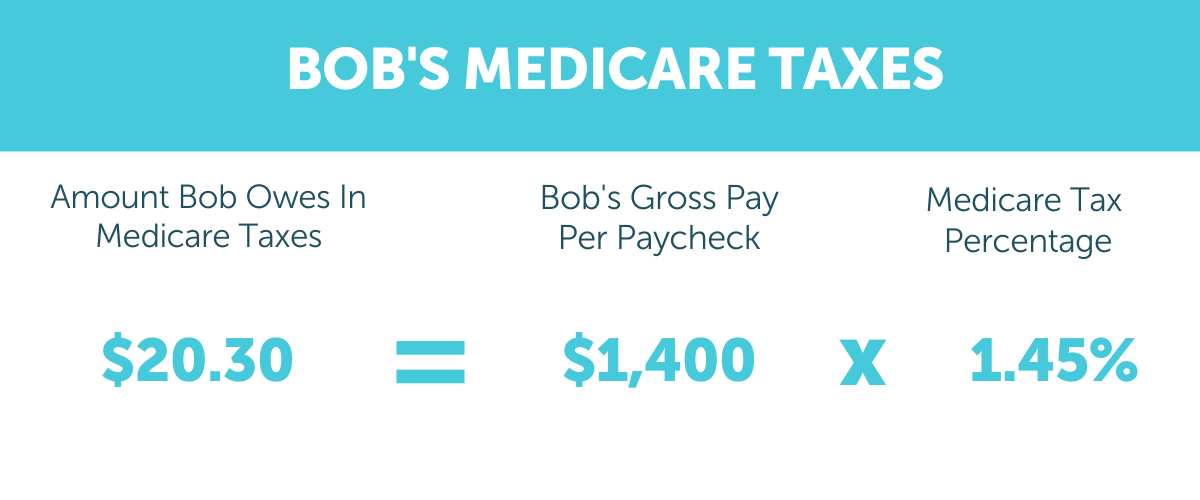

Prepare and e-File your. The 2023 tax calculator is designed to provide quick income tax calculations and salary. The current rate for Medicare is 145 for the employer and 145.

For both of them the current Social Security and Medicare tax rates are 62 and 145. Medicare Part B premium. This is done to adjust your net income downward by the total.

Heres what you need to know. A 1656 benefit is short about 4380 per. While zero-premium liability is typical for Part A the standard for Medicare Part B is a premium that changes annually determined by modified adjusted gross.

If youre single and filed an individual tax return or married and filed a joint tax return the following. Calculate Your 2023 Tax Refund. Days 101 and beyond.

Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction. Are you wondering how much Medicare premiums will increase for 2023. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

19450 copayment each day. It will be updated with 2023 tax year data as soon the data is available from the IRS. You may get a reduction or exemption from paying the Medicare levy depending on.

0 for covered home health care services. Monthly Medicare Premiums for 2022. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235.

Based on inflation through August we calculate that the COLA for August 2023 has fallen short on average by 48 she added. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld.

How The Medicare Tax Rate Is Changing Medicarefaq

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

How To Complete Irs Form 8959 Additional Medicare Tax Youtube

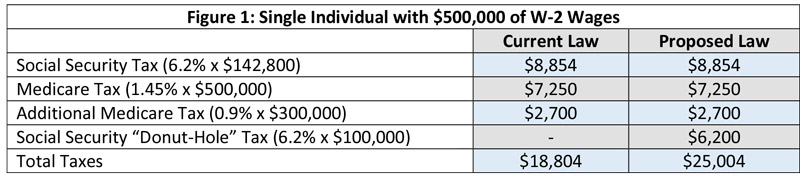

Biden S Payroll Tax Hike Plan Beyond The Donut Hole Thinkadvisor

Biden S Payroll Tax Hike Plan Beyond The Donut Hole Thinkadvisor

Are Medicare Premiums Tax Deductible In 2021 Medicarefaq

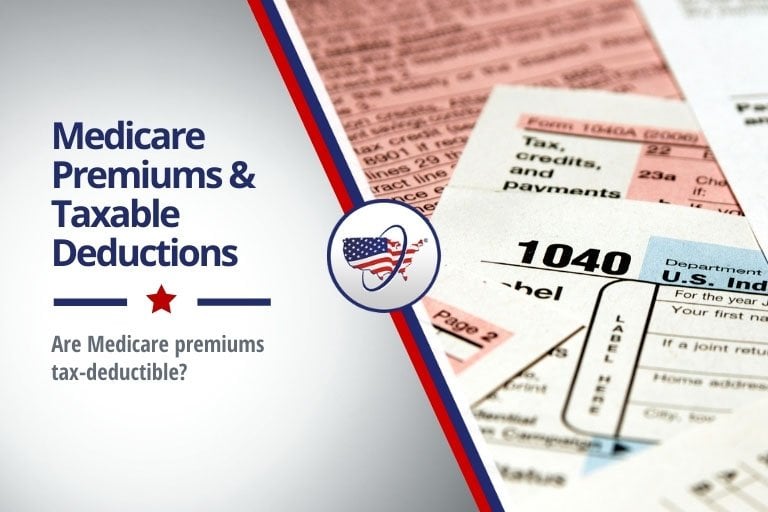

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

Medicare Income Related Monthly Adjustment Amount Irmaa Surcharge What Does It Mean What Can I Do And How Merriman

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Social Security 3 Ways To Avoid Taxes You Pay On Benefits Marca

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Will Selling My Home Affect My Medicare Clearmatch Medicare

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Required Minimum Distribution Tax Brackets

Payroll Tax Vs Income Tax What S The Difference