My paycheck after taxes

What is my take home pay after taxes in Colorado. The specifics of filing taxes after divorce and how you draw up your divorce agreement could make a big difference when it comes to your tax refund.

Hrpaych Yeartodate Payroll Services Washington State University

Even if you did a Paycheck Checkup last year you should do it again to account for differences from TCJA or life changes.

. If you want to ship the Budget by Paycheck Workbook internationally import duties taxes or other charges are not included in our shipping price. Our network attorneys have an average customer rating of 48 out of 5 stars. More Information on Paycheck Taxes.

These taxes include 124 percent of compensation in Social Security taxes and 29 percent of salary in Medicare taxes totaling 153 percent of each paycheck. You can either enter the year-to-date YTD figures from your payslip or for a single pay period. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an HR Block or Block Advisors office and paid for that tax preparation.

On the other hand. Salary Paycheck Calculator How much are your wages after taxes. If your 2021 Tax Return status filed in 2022 is still being shown by the IRS as processed or processing after you have e-filed your return this means that the IRS has your return but it is still in the refund processing phase.

The federal income tax you pay depends partly on how much of your paycheck is considered taxable income. The Budget By Paycheck Workbook changed my life by allowing me to no longer have to choose between food or bills. The following check stub calculator will calculate the percentage of taxes withheld from your paycheck and then use those percentages to estimate your after-tax pay on a different gross wage amount.

Guest Bloggers Taxes How the Savers Credit Can Help You Save for Retirement. Referring client will receive a 20 gift card for each valid new client referred limit two. The timeframe of this can vary depending on how long the IRS reviews your return.

This refreshes your payroll information to calculate the taxes on the transaction. Tax reform changes likely to reduce number of taxpayers who itemize. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States.

For more troubleshooting solutions when payroll taxes are not withholding please refer to these articles. The average local income tax collected as a percentage of total income is 013. I learned where I was absolutely bleeding my funds dry and changed my mindset.

A 100000 paycheck is much smaller after taxes. The Best Paystubs Generate 100 Legal Pay Stubs W-2 and 1099 MISC Verified by US tax professionals Access Support 247 We make it easy. This financial maneuver can affect your personal cash flow -- making a difference youre in a bind or need more money.

April 14 2021 By Catherine Collison CEO and president of nonprofit Transamerica Institute and its Transamerica Center for Retirement Studies. Estimate Taxes on Paycheck from Pay Stub. With recent tax law changes the IRS urges taxpayers to look into whether they need to adjust their paycheck withholding and submit a new Form W-4 to their employer.

Also the percentage of federal income tax deducted from your paycheck rises as your taxable income increases. Your goal in this process is to get from the gross pay amount gross pay is the actual amount you owe the employee to net pay the amount of the employees paycheck. Get the right guidance with an attorney by your side.

The IRS was backlogged on processing and issuing. The standard monthly premium for 2021 is 14850. After-tax retirement service credit purchases Taxes taken from your paycheck as deductions.

Use the hourly paycheck calculator to see your take home pay after taxes in Colorado. After you have calculated gross pay for the pay period you must then deduct or withhold amounts for federal income tax withholding FICA Social SecurityMedicare tax state. However university employees hired after 4186 are required to pay the medicare portion of Social Security.

Federal State Local School Tax. Taxable income is the amount left over after withholding allowances and other tax-exempt amounts are subtracted from your total pay. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Premiums with Medicare Part C also known as Medicare Advantage follow the same rules as Part B. This form tells your employer how much to withhold from your paycheck. The IRS caps the deduction limit at 750000 for mortgage debt incurred after 15th Dec 2017 and up to 1 million if you got your mortgage earlier.

Referred client must have taxes prepared by 4102018. Right-click the name of your employee which highlighted in yellow. University employees do not pay into Social Security.

The Federal Insurance Contributions Act FICA is a federal law that requires employers to withhold three different types of employment taxes from their employees paychecks. While this is an itemized deduction after the 2017 tax reform itemization no longer applies. Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal income tax withholding this year.

You can learn more about how the Michigan income tax compares to other states income taxes by visiting our map of income taxes by state. Open your employees Payroll Information. The IRS lets you deduct medical costs that exceed 75 percent of your adjusted gross income AGI which is your yearly income after taxes.

Adjust your tax withholding to get more money per paycheck. You will each fill out a W-4. IR-2018-230 Get Ready for Taxes.

We used SmartAssets paycheck calculator to find out how much Americans earning a 100000 salary take home after federal state and local. IR-2018-222 IRS provides tax inflation adjustments for tax year 2019. IR-2018-127 Law change affects moving.

Saving for retirement can be difficult in the best of times but even harder during a pandemic. Taxpayers can use the updated Withholding Calculator on IRSgov to do a quick paycheck checkup to check that theyre not having too little or too much tax withheld at work. If youre expecting a big refund.

Michigan allows counties and municipalities to collect a local surtax on top of the Michigan state income tax. Free for personal use. Joint filers need to split their W-4 withholding between both spouses so if you divorce.

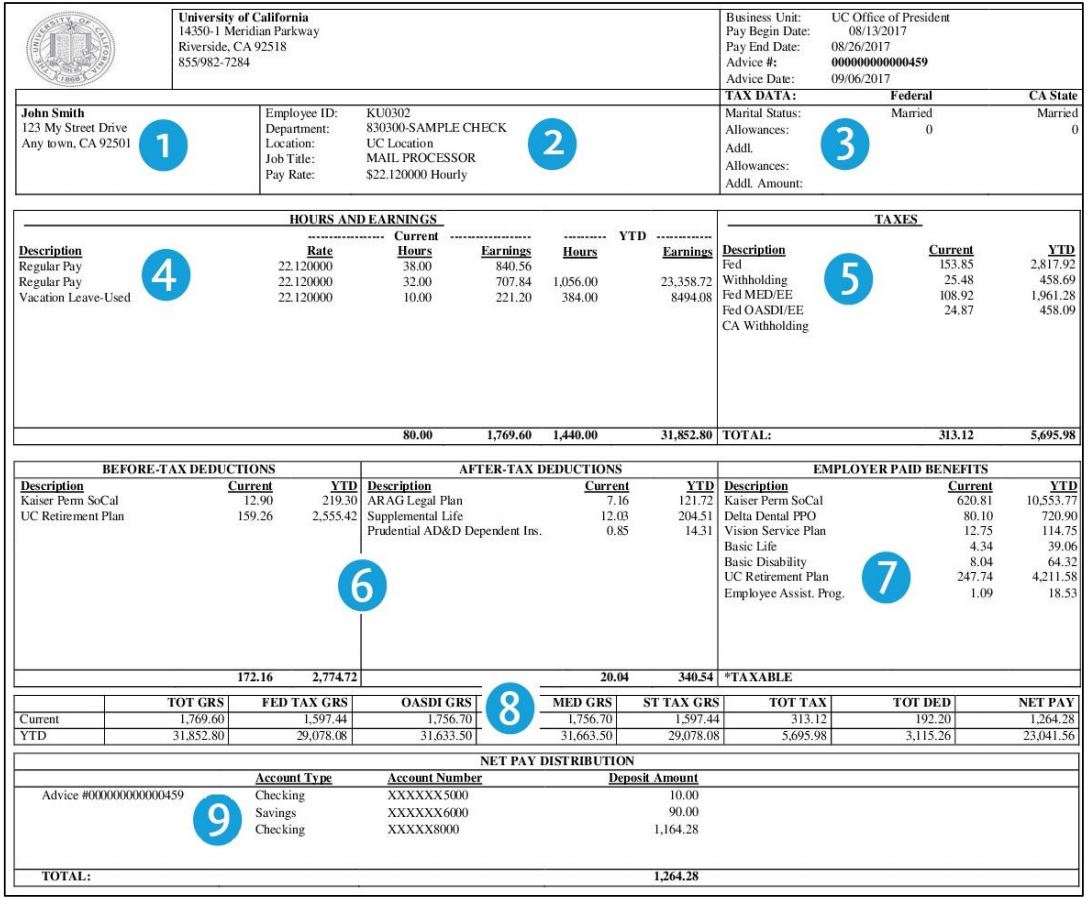

If you have questions about other amounts or tax items on your paycheck stub check with your manager or your human resources department.

Check Your Paycheck News Congressman Daniel Webster

My Paycheck Administrative Services Gateway University At Buffalo

Understanding Your Paycheck Credit Com

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding Your Paycheck

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Free Online Paycheck Calculator Calculate Take Home Pay 2022

New Paycheck Ucpath

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Here S How Much Money You Take Home From A 75 000 Salary

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Tax Information Career Training Usa Interexchange

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Calculator Online For Per Pay Period Create W 4

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Here S How Much Money You Take Home From A 75 000 Salary

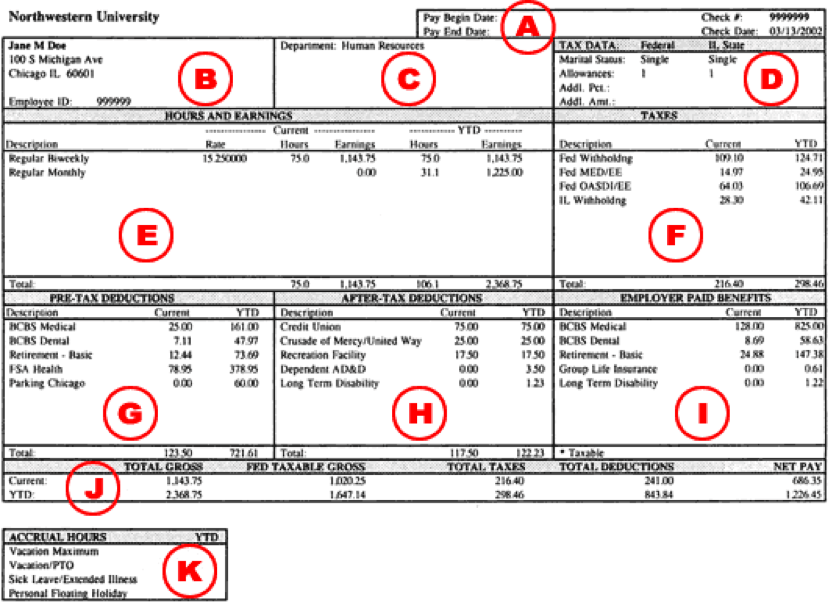

Understanding Your Paycheck Human Resources Northwestern University